Steuer-ID

Inhaltsverzeichnis

- Steuerliche Identifikationsnummer Begrifflichkeit

- Wo finde ich meine Steuer-ID?

- Was kann ich tun, wenn ich meine Steuer-ID nicht finde?

- Was kann ich tun, wenn ich keine Steuer-ID und einen Migrationshintergrund habe und in Deutschland gemeldet bin?

- Was kann ich tun, wenn ich keine Steuer-ID und einen Migrationshintergrund habe, aber nicht in Deutschland gemeldet bin?

- Was ist die Steuer-ID in Abgrenzung zur Steuernummer?

Steuerliche Identifikationsnummer Begrifflichkeit

Eine Steuer-ID wird jeder Person, die mit der Hauptwohnung oder der alleinigen Wohnung in einem Melderegister in Deutschland erfasst ist, zugeteilt. Personen, die nicht melderechtlich erfasst, aber in Deutschland steuerpflichtig sind, erhalten ebenfalls eine Steuer-ID. Wer steuerpflichtig ist, regeln die einzelnen Steuergesetze.

Wo finde ich meine Steuer-ID?

Du findest in der Regel deine Steuer-ID in den folgenden Dokumenten:

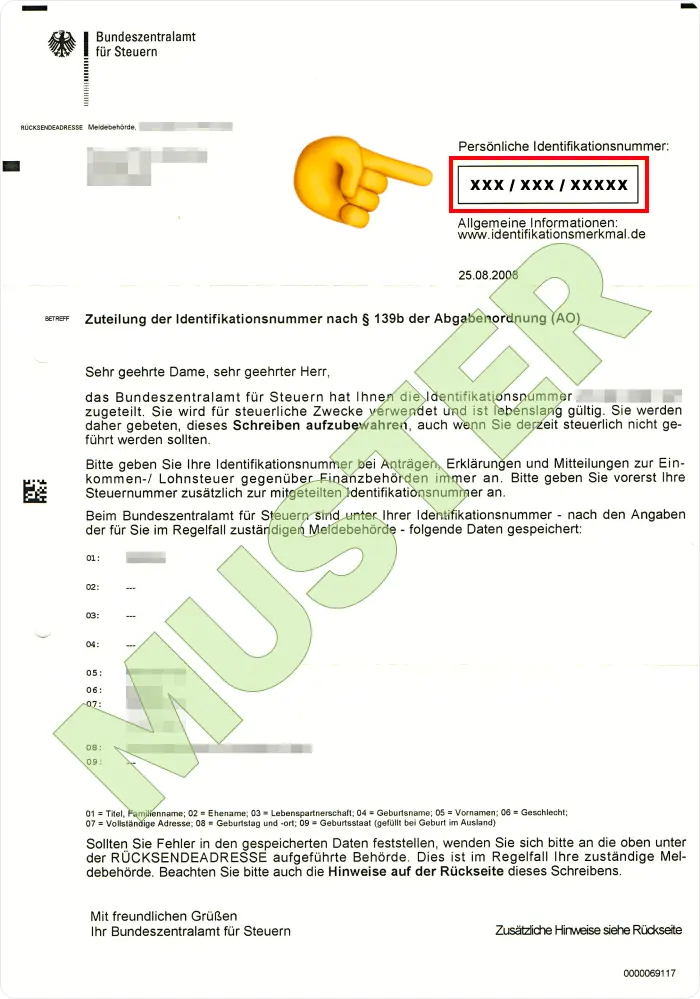

- Schreiben zur Zuteilung der Identifikationsnummer nach §139b der Abgabeordnung

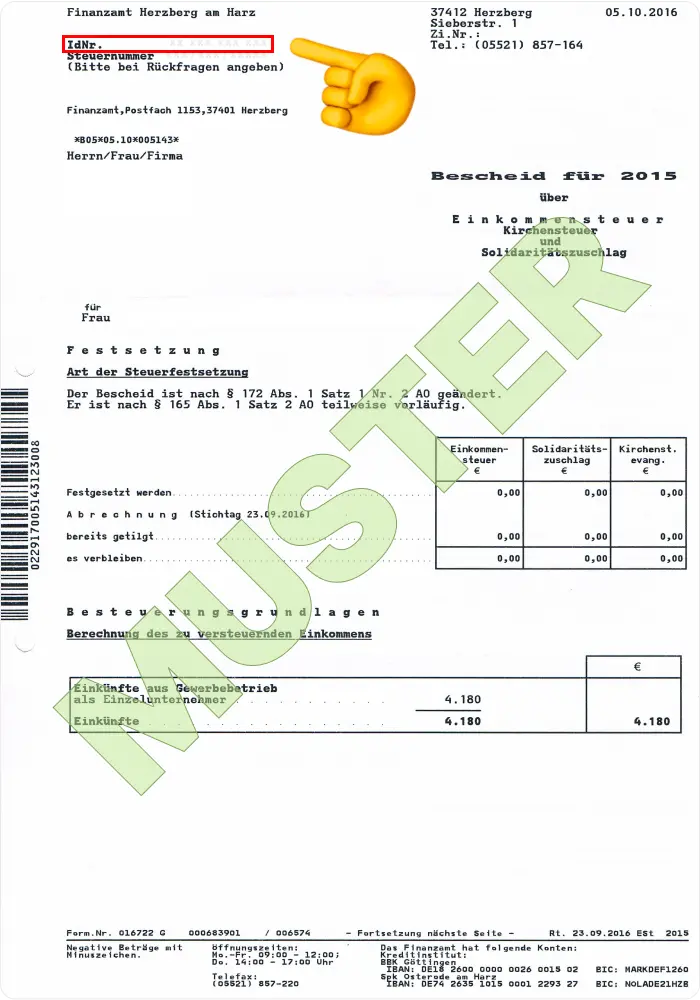

- Einkommensteuerbescheid

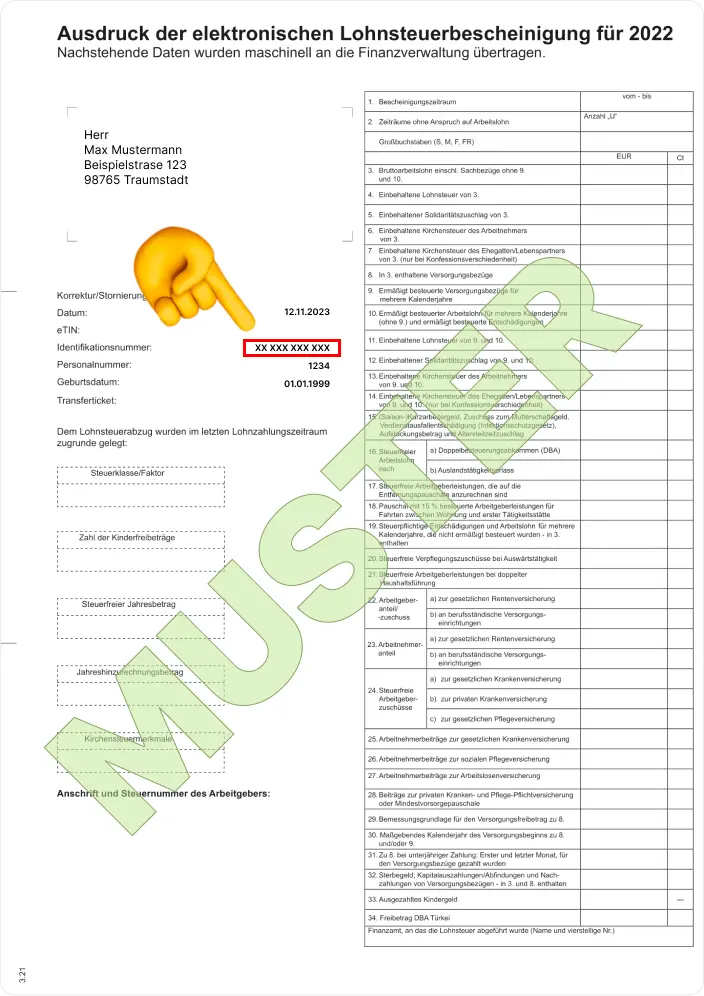

- Lohnsteuerbescheinigung

Was kann ich tun, wenn ich meine Steuer-ID nicht finde?

Findest du deine Steuer-ID in den genannten Unterlagen nicht, dann kannst du diese über das Eingabeformular des Bundeszentralamts für Steuern oder per Brief erneut anfordern. Die Steuer-ID kann aus datenschutzrechtlichen Gründen nur per Brief mitgeteilt werden. Der Versand der Steuer-ID an eine Anschrift, die nicht deiner Meldeanschrift entspricht, kann nur mit deiner schriftlichen Vollmacht (per Brief und mit einer Kopie deines Personaldokuments) erfolgen.

Deine Einkommensteuererklärung kannst du auch ohne Steuer-ID bei deinem Finanzamt einreichen. Diese ist deinem Finanzamt bekannt oder kann ermittelt werden.

Das BZSt kann Ihnen die Ihnen zugeordnete Steuer-ID mitteilen:

Falls die Identifikationsnummer nicht auffindbar ist, kann sie über das Eingabeformular des Bundeszentralamts für Steuern oder per Brief erneut angefordert werden.

Bei Fragen zur Steuer-ID bietet das Bundeszentralamt für Steuern verschiedene Kontaktmöglichkeiten, einschließlich des Chatbots ViOlA und telefonischer Anfragen. Die Steuer-ID kann auch auf dem BZSt Online Portal erneut mitgeteilt werden.

Was kann ich tun, wenn ich keine Steuer-ID und einen Migrationshintergrund habe und in Deutschland gemeldet bin?

Auch wenn Du keinen deutschen Pass hast, aber beim Einwohnermeldeamt gemeldet bist, solltest Du eine persönliche Identifikationsnummer postalisch erhalten haben. Du kannst diese beim Finanzamt erfragen.

Was kann ich tun, wenn ich keine Steuer-ID und einen Migrationshintergrund habe, aber nicht in Deutschland gemeldet bin?

Bist Du nicht in Deutschland gemeldet, arbeitest aber hier (“Person ohne Meldepflicht”), dann wende Dich an Dein zuständiges Finanzamt, welches die Steuer-ID dann beim BZSt anfragt.

Personen ohne Meldepflicht, wie in Deutschland arbeitende Ausländer oder Personen ohne festen Wohnsitz, können beim Finanzamt eine Identifikationsnummer beantragen. Das betrifft vor allem:

- Personen mit ausländischem Wohnsitz, die in Deutschland arbeiten (z.B. Austausch Studenten)

- Personen im Inland ohne ständigen Wohnsitz, zum Beispiel Obdachlose

Die Steuer-ID wird schriftlich an die Wohnsitzadresse (auch im Ausland) geschickt. Die betroffene Person kann auch eine empfangsberechtigte Person (z.B. Arbeitgeber) im Antrag benennen.

Voraussetzungen für die Antragstellung sind:

- Keine Meldepflicht in Deutschland aufgrund fehlenden Wohnsitzes.

- Bestehende Steuerpflicht oder Ausübung einer nichtselbständigen Tätigkeit in Deutschland.

Erforderliche Unterlagen für den Antrag:

- Ausgefüllter Antrag auf Vergabe der Identifikationsnummer - Link

- Kopie von Personalausweis oder Pass.

- Das Antragsformular ist auf der Website des Bundesministeriums für Finanzen im Formularcenter verfügbar.

Was ist die Steuer-ID in Abgrenzung zur Steuernummer?

Beachte: Die Steuernummer ist nicht mit der Steuer-ID zu verwechseln. Hierbei handelt es sich um zwei unterschiedliche Nummern! Für die Einstellung bei deinem neuen Arbeitgeber benötigst du deine Steuer-ID.

- Steuer-ID: Die Steuer-ID ist im Unterschied zur Steuernummer eine personenbezogene Nummer und bleibt lebenslang gültig, auch bei Umzügen oder Namensänderungen. Du solltest die Steuer-ID bei jeder Kommunikation mit dem Finanzamt angeben. Wichtig zu wissen: Die Steuer-ID kannst du nicht beim Finanzamt beantragen, sie wird vom Bundeszentralamt für Steuern (BZSt) vergeben.

Die Steuer-ID hat 11 Stellen und folgendes Format: XX XXX XXX XXX

- Steuernummer: Die Steuernummer wird vom örtlichen Finanzamt vergeben und ändert sich, wenn du in eine andere Stadt ziehst. Du kannst sie beim Finanzamt erfragen oder neu beantragen. In den kommenden Jahren wird die Steuernummer abgeschafft und wird nur für die Steuererklärung benötigt. Ursprünglich sollte die Einführung der persönlichen Steuer-Identifikationsnummer das alte System der Steuernummer ersetzen.

Die Steuernummer hat bis zu 13 Stellen und meist folgendes Format: XXX / XXX / XXXXX

Bitte beachte, die Steuernummer kann je nach Bundesland in einigen kleinen Details variieren.

Die folgende Tabelle zeigt, wie die Steuernummer in den verschiedenen Bundesländern aufgebaut ist. Hierbei ist bezüglich des das Standardschema der Länder vom vereinheitlichten Bundesschema abzugrenzen. Es handelt sich aber um die gleiche Nummer!

F = Ziffer der Finanzamtsnummer, B= Ziffer der Bezirksnummer, U = Ziffer aus der persönlichen Unterscheidungsnummer, P = Prüfziffer